Margin Trading PrimeXBT: A Comprehensive Guide

In the world of cryptocurrency trading, margin trading has emerged as a powerful tool for traders looking to maximize their profits. One of the platforms leading the charge in this realm is Margin Trading PrimeXBT https://primexbt-ltd.com/giao-dich-ky-quy/. In this article, we will explore what margin trading is, how it works on PrimeXBT, and the strategies you can adopt to enhance your trading experience.

What is Margin Trading?

Margin trading refers to the practice of borrowing funds from a broker to trade larger positions than your current capital allows. This essentially means that you can leverage your investments, magnifying your potential profits. However, this also means that your losses can be greater if the market moves against you. Margin trading is available in various financial markets, including stocks, forex, and cryptocurrencies, and it has become increasingly popular among cryptocurrency traders.

The Mechanics of Margin Trading on PrimeXBT

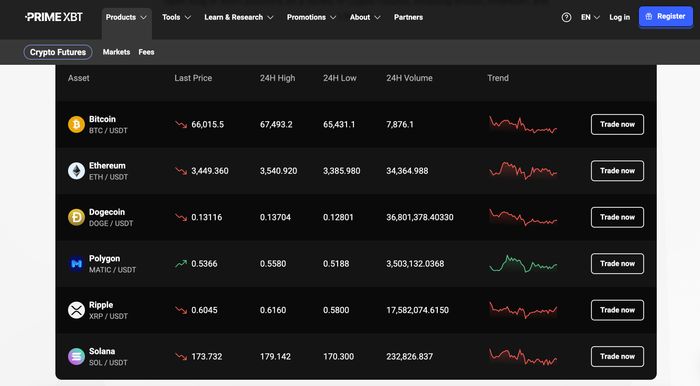

PrimeXBT offers a robust margin trading feature that allows users to trade various cryptocurrencies with leverage. Here’s how it works:

1. Opening a Margin Account

To start margin trading on PrimeXBT, you must first create an account on the platform. Once you have registered and verified your account, you can deposit funds that you intend to use for trading. PrimeXBT supports multiple cryptocurrencies, allowing for flexibility in funding your account.

2. Understanding Leverage

Leverage is a key component of margin trading. On PrimeXBT, you can use leverage up to 100x depending on the trading pair. This means that for every $1 you invest, you can control a position worth $100. While this can amplify your profits, it’s crucial to understand that it also increases your risk significantly.

3. Placing a Margin Trade

Once your account is funded, you can start placing trades. PrimeXBT offers an intuitive trading interface where you can select your desired trading pair, choose the amount you want to trade, and set your leverage. The platform allows for both long and short positions, enabling traders to profit from both rising and falling markets.

4. Margin Calls and Liquidation

One of the inherent risks of margin trading is the possibility of a margin call or liquidation. If the market moves against your position and your equity falls below a certain level, PrimeXBT may issue a margin call, requiring you to deposit more funds. If your account balance reaches a point where it can no longer support your open positions, the platform may liquidate your assets to recover the borrowed amount.

Benefits of Margin Trading on PrimeXBT

There are several advantages to using margin trading on PrimeXBT:

1. Amplified Returns

The primary benefit of margin trading is the potential for amplified returns. By using leverage, you can increase your exposure to the market, which may result in higher profits compared to trading with just your own capital.

2. Flexibility in Trading Strategies

Margin trading provides traders with the flexibility to adopt various trading strategies, including short selling. This allows you to capitalize on market volatility, whether prices are rising or falling.

3. HEDGING Opportunities

Margin trading can also be used as a hedging strategy to protect your investments against potential losses. By taking a short position on a cryptocurrency that you hold, you can offset potential losses in your portfolio.

Risks of Margin Trading

Despite the potential rewards, margin trading comes with significant risks:

1. Increased Losses

While margin trading can magnify profits, it can also amplify losses. If a trade goes against you, the losses could exceed your initial investment, resulting in a margin call or liquidation.

2. Market Volatility

The cryptocurrency market is notorious for its volatility. Sudden price fluctuations can trigger margin calls and affect your ability to maintain your positions, which could lead to significant financial distress.

3. Psychological Pressure

Margin trading can also place psychological pressure on traders. The fear of losing money may lead to irrational decision-making, resulting in poor trading choices.

Best Practices for Margin Trading on PrimeXBT

To succeed in margin trading, consider the following best practices:

1. Educate Yourself

Before engaging in margin trading, take the time to educate yourself on market trends, analyses, and trading strategies. Knowledge is your best tool for success.

2. Start Small

If you are new to margin trading, consider starting with a smaller amount of leverage. This will help you gauge your risk tolerance and build your trading skills without exposing yourself to excessive risk.

3. Utilize Stop Losses

Make use of stop-loss orders to protect your investments. Setting a stop loss can help you exit a position before losses become too significant.

Conclusion

Margin trading on PrimeXBT offers exciting opportunities for traders looking to maximize their profits through leveraged positions. However, it is crucial to understand the inherent risks and employ sound trading strategies to mitigate potential losses. By taking a disciplined approach, investing time in education, and utilizing risk management techniques, you can enhance your trading experience and navigate the dynamic world of cryptocurrency with confidence.